Contents

Twój serwer jest w pełni kontrolowany przez Ciebie i może być wykorzystywany według Twoich preferencji. Serwery VPS SSD Wykorzystaj potencjał szybkich dysków SSD w serwerach. Szybkie WWW Dlaczego warto używać LiteSpeed?

- Twoje terminale MetaTrader, EA, wskaźniki oraz inne oprogramowanie będą dostępne w każdej chwili i wszędzie, gdzie jest dostęp do Internetu.

- Opłaty Wnioskodawca wykonuje za pomocą karty debetowej powiązanej z kontem bankowym prowadzonym w walucie USD.

- Od 74% do 89% rachunków inwestorów detalicznych odnotowuje straty pieniężne w wyniku handlu kontraktami CFD.

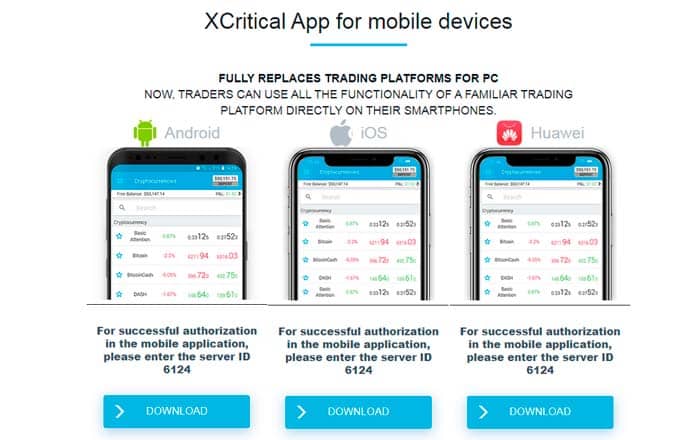

- Do tego potrzebne będzie nam oprogramowanie dostępne w standardzie na Windowsie (usługa „Podłączenie pulpitu zdalnego”).

- W sprawie informacji stanowiących rekomendacje dotyczące instrumentów finansowych, ich emitentów lub wystawców (Dz. U. z 2005r. Nr 206, poz. 1715).

Zastanów się, czy rozumiesz, jak działają kontrakty CFD, i czy możesz pozwolić sobie na wysokie ryzyko utraty twoich pieniędzy. 74-89% rachunków inwestorów detalicznych odnotowuje straty w wyniku handlu kontraktami CFD. Zastanów się, czy rozumiesz, jak działają kontrakty CFD, i czy możesz pozwolić sobie na wysokie ryzyko utraty pieniędzy. Wszystkie treści zamieszczone na stronie i jej podstronach mają wyłącznie charakter informacyjny i prezentują opinie własne autorów. Treści te sporządzone zostały rzetelnie, z należytą starannością i nie stanowią podstawy do podejmowania decyzji inwestycyjnych, porady inwestycyjnej ani rekomendacji w rozumieniu rozporządzenia Ministra Finansów z dnia 19 października 2005 r.

Klient otrzymuje pełny dostęp do serwera VPS za pomocą podanego hasła administratora. Od tego momentu tylko klient ponosi odpowiedzialność za wyniki użytkowania VPS. Windows VPS – jest hostingiem serwerów wirtualnych z systemem operacyjnym Windows Server. Główną zaletą takiego Windows hostingu jest oszczędność, bo płacisz tylko za te zasoby, których potrzebujesz na chwilę obecną. Jeżeli Twój projekt przerośnie wybraną konfigurację lub zatrudnisz więcej osób – w dowolną chwilę można zwiększyć pakiet.

Subskrybuj usługę FxPro VPS

Jeżeli posiadasz już konto XM, podaj swój nr ID konta, aby nasz zespół wsparcia mógł zapewnić Ci najlepszą możliwie obsługę. W oknie Połączenia pulpitu zdalnego wpisz adres IP XM VPS, który otrzymałeś/-aś wcześniej i kliknij przycisk „Połącz”. Dzięki VPS XM Twoje automatyczne systemy transakcyjne będą mogły pracować bez przerwy, bez konieczności ich monitorowania lub nawet włączania komputera. Usługa VPS XM zapewni Ci dostęp do systemu Windows Server 2012 z 1,3 GB pamięci RAM, 25 GB pojemności dysku twardego i 1 procesorem wirtualnym. W ten sposób otrzymujesz stabilne i szybkie środowisko handlowe, idealne dla traderów korzystających z Expert Advisors. Uzyskaj dostęp do swojego rachunku z dowolnego komputera na świecie, bez konieczności instalowania MetaTrader 4, MetaTrader 5.

W sprawie informacji stanowiących rekomendacje dotyczące instrumentów finansowych lub ich emitentów (Dz.U. z 2005 r. Nr 206, poz. 1715). VPS lub Virtual Private Server to najlepsze rozwiązanie dla traderów forex, którzy chcą https://forexgenerator.net/ utrzymywać stałe połączenie z rynkiem i używają automatycznych strategii handlowych. Ta usługa umożliwia korzystanie z Expert Advisor oraz integrację sygnałów i aplikacji innych producentów na platformie transakcyjnej.

Jeśli chodzi o ogólny poziom oferowanych usług, FP Markets jest jednym z najlepszych brokerów Forex i CFD. Z jego oferty skorzystają zarówno początkujący i doświadczeni traderzy, jak i menedżerowie rachunków i IB korzystający z kont MAMM i PAMM. Aby uzyskać więcej informacji na temat FP Markets, przeczytaj naszą recenzję brokera.

Korzystając z tej strony, wyrażasz zgodę na przetwarzanie przez Google danych o Tobie w sposób i w celach określonych powyżej. Do kosztów uzyskania przychodów wnioskodawca będzie mógł zaliczyć np. Opłaty za przelewy z konta bankowego na konto brokerskie, opłaty za dostęp do sygnałów transakcyjnych, opłaty za dostęp do serwera VPS. 3 i 4, nie powiększają wartości początkowej środka trwałego oraz wartości niematerialnych i prawnych. Czy do kosztów uzyskania przychodu z tytułu transakcji na rynku forex można zaliczyć opłaty za dostęp do serwera VPS. 1 pkt 38a ustawy o podatku dochodowym za koszty uzyskania przychodów z transakcji na rynku forex można uznać wyłącznie poniesione, celowe, bezpośrednie i właściwie udokumentowane wydatki związane z nabyciem pochodnych instrumentów finansowych.

Serwer VPS z systemem Windows

W przypadku wymienionych instrumentów działanie dźwigni finansowej może przyczynić się do wystąpienia strat przekraczających depozyt początkowy inwestora. Inwestycje na rynku Forex wiążą się ze znacznym stopniem ryzyka finansowego, łącznie z możliwością utraty wszystkich zainwestowanych funduszy i mogą nie być odpowiednie dla każdego. Upewnij się, że w pełni zdajesz sobie z tego sprawę, oraz nie inwestuj środków, na utratę których nie możesz sobie pozwolić. Pamiętaj, że powinieneś posiadać odpowiednią wiedzę i umiejętności, a także podejmować własne działania inwestycyjne, a zaprezentowane oprogramowanie ma jedynie charakter pomocniczy.

1GB ramu gwarantuje stabilną pracę nawet najbardziej wymagających automatycznych strategii. Zarówno VPS jak i fizyczna maszyna pracuje z systemem CentOS, który gwarantuje odporność na wirusy. Jest to bardzo ważna kwestia, ponieważ tu chodzi o Twoje pieniądze, a większość złośliwego oprogramowania działa tylko z systemem Windows. Dostęp zdalny odbywa się oczywiście z dowolnego systemu opracyjnego. VPS jest zabezpieczony hasłem, więc nikt niepowołany nie uzyska do niego dostępu.

W celu umożliwienia nam zapamiętania Twoich preferencji oraz identyfikacji Ciebie jako użytkownika, upewnienia się, że Twoje dane są bezpieczne oraz zapewnienia bardziej niezawodnego i sprawnego działania strony. Pliki cookie pozwalają na przykład zaoszczędzić Ci trudu wpisywania nazwy użytkownika za każdym razem, kiedy uzyskujesz dostęp do platformy transakcyjnej oraz przywołują Twoje preferencje, jak np. Język, który chcesz widzieć przy logowaniu. Pliki cookie nie przenoszą wirusów ani złośliwego oprogramowania na komputer. Aby zapewnić, że nasi inwestorzy korzystają z niezawodnej realizacji bez konieczności martwienia się o trudności techniczne, nawiązaliśmy współpracę z ForexVPS, jednym z najbardziej godnych zaufania dostawców VPS na rynkach. Wszyscy inwestorzy, którzy w miesiącu kalendarzowym obrócą co najmniej 15 lotów, kwalifikują się do tej bezpłatnej usługi.

Dla serwera dedykowanego:

Wszystkie nasze serwery forex znajdują się w centrach danych takich firm jak Equinix, Global Switch, Level3 czy INTERNAP (tam gdzię większość brokerów na swoje serwery). Rozumiemy, że aby utrzymać dogodne warunki pracy, inwestorzy muszą skupić się na znalezieniu skutecznych metod handlu, zamiast martwić się o przestrzeganie przez brokera warunków współpracy. W związku z tym dołożyliśmy wszelkich starań, aby chronić nasze zobowiązania wobec klientów za pośrednictwem polisy ubezpieczeniowej odpowiedzialności cywilnej dla brokerów Forex o wartości do 2,500,000 EUR.

Porownaniebrokerow.pl nie ponosi odpowiedzialności za żadne straty handlowe poniesione przez korzystających z informacji zawartych na tej witrynie. Porownaniebrokerow.pl z największą uwagą i obiektywizmem analizuje i recenzuje najlepszych brokerów online. Dostarcza narzędzia, szkolenia i wiarygodne informacje, aby pomóc inwestorom wybrać najlepszego brokera do inwestowania, uniknąć ryzyka i poszerzyć możliwości handlowe. Hosting VPS umożliwia dalsze korzystanie z komputera w celu prowadzenia handlu nawet podczas przerw w dostawie prądu, rozłączenia z Internetem i nieoczekiwanych wyłączeń. Wystarczy połączyć się ze zdalnym terminalem, którego serwer znajduje się w pobliżu naszych serwerów i wykonywać wszystkie operacje handlowe z dowolnego komputera , bez konieczności instalowania jakiegokolwiek oprogramowania. MonitorFX tworzymy z pasji do tradingu online na globalnym rynku finansowym.Transakcje CFD i Forex oparte na dźwigni finansowej są wysoce ryzykowne dla Twojego kapitału.

Serwery VPS MT4

FxPro uruchomiło właśnie nową usługę dla klientów korzystających z platformy Meta Trader 4. Jest ona dostarczana przez firmę BeekFX VPS, będącą jednym z liderów w swoim segmencie usługowym. Dowiedz się, jak ustawić i korzystać ze swojej usługi VPS dzięki naszej instrukcji obsługi. Używanie wirtualnego serwera VPS do handlu na rynku Forex to kolejny krok wtajemniczenia. VPS – na forach często przewija się ten tajemniczy skrót.

Przy kwalifikacji do otrzymania bezpłatnej usługi wirtualnego prywatnego serwera VPS bierzemy także pod uwagę wszystkie inne konta transakcyjne zarejestrowane przez klienta przy użyciu tego samego adresu e-mail. Broker świadczący usługę vps na forexie gwarantuje, że szybkość i pojemność aplikacji będzie zgodna ze specyfikacją serwera. Duzi brokerzy oferują hosting vps z wielojęzycznym interfejsem i działem pomocy.

Czym jest GameFi i jakie ma znaczenie dla inwestorów oraz świata gier?

W sprawie informacji stanowiących rekomendacje dotyczące instrumentów finansowych, ich emitentów lub wystawców (Dz. U. z 2005 r., Nr 206, poz. 1715). Portal nie ponosi odpowiedzialności za wszelkie transakcje, szkody, poniesione wydatki oraz utracone korzyści powstałe w związku z decyzjami inwestycyjnymi podejmowanymi w oparciu o udostępnione na stronie treści. 1 ustawy o podatku dochodowym od osób fizycznych, zgodnie z którym od dochodów uzyskanych z odpłatnego zbycia m.in. Pochodnych instrumentów finansowych, i z realizacji praw z nich wynikających podatek dochodowy wynosi 19% uzyskanego dochodu.

Wnioskodawca uruchomił to oprogramowanie na serwerze VPS (Virtual Private Server – serwer wirtualny). Dostęp do serwera VPS obarczony jest miesięczną opłatą wyrażoną w walucie USD. W ramach reinwestycji środków pieniężnych zarobionych z tytułu prowadzenia działalności gospodarczej Wnioskodawca dokonuje transakcji na rynku forex.

Pamiętaj, że minimalny ping i lokalizację VPS najbliżej serwerów głównego brokera może zapewnić tylko twój broker. Poza tym możesz łatwo aktywować serwer bezpośrednio w swoim osobistym profilu. Środki są aktywowane i pobierane za hosting bezpośrednio za pośrednictwem osobistego profilu na stronie internetowej firmy. Bliskie sąsiedztwo VPS z serwerami głównej firmy gwarantuje minimalne opóźnienie w realizacji zamówień. Dużą zaletą usługi jest zdalna kontrola nad platformą handlową oraz systemami oprogramowania i sprzętu. Użytkownik usługi vps może zdalnie dostosować ustawienia robotów i doradców w celu poprawy ich wydajności.

Co daje możliwość rozwoju bez zbędnych opłat na początku. Szybkość i stabilność serwerów VPS zapewnia technologia wirtualizacji KVM. I zamiast tego, aby kupować nowy sprzęt czy komputer wystarczy po prostu zmienić pakiet hostingowy. W każdej chwili możesz samodzielnie dokonać upgrade VPS Windows na wyższy pakiet hostingowy bezpośrednio z panelu VPS lub poprosić o to nasz support w zgłoszeniu.

Na system operacyjny, procesor, pamięć RAM, miejsce na dysku, dostęp do adresów IP itd.. Zasoby gwarantowane do których maszyna ma dostęp zawsze oraz opcjonalnie takie, które mogą być dostępne tylko chwilowo Goldman Sachs Am Absolwent akcji powraca po sześciu latach z BlackRock (np. w zależności od stopnia obciążenia całości serwera). Upraszczając całą definicję – jest to komputer na którym możemy wykonywać standardowe operacje, tyle, że występuje tylko w formie on-line.

Dostęp do spersonalizowanej platformy z każdego miejsca na świecie. W przypadku, gdy nasz trading wymaga nietuzinkowych ustawień i/lub narzędzi dodanych do platformy, przemieszczanie się lub podróż wymaga od nas ciągnięcia ze sobą laptopa. Jednak jeśli wszystko zostaje uruchomione na VPS-ie mamy dostęp do skonfigurowanej przez nas aplikacji z każdego miejsca na ziemi (o ile mamy dostęp do jakiegokolwiek komputera, tabletu lub smartfona i internetu 🙂 ).

Idealny serwer do zdalnej pracy dostępny 24/7. Szybkie Dyski SSD. https://forexformula.net/ Polska lokalizacja. Na co zwrócić uwagę przy wyborze serwera.

.jpeg)

.jpeg)

.jpeg)

.jpeg)

.jpeg)